We often talk about wholesome education for children. Gone are the days when kids were told to focus only on their studies and it was assumed that the only way to succeed in life was to score well in school and crack some competitive exam. Times have changed now and children need all-round education and development. It is essential to equip our children with real life skills and not just bookish knowledge.

One of the basic life skills that is essential for children in money matters. Children are dependent on their parents for their needs and parents also try their best to fulfil all their needs. However, as they reach a certain age, it is important to make them understand that money cannot be taken for granted and that it takes a lot of hard work to earn money which should be utilised judiciously.

Why Teach Money Skills to Children

Life is full of challenges and one of the most important skills one needs to navigate life is finance. My daughter is in grade 2 and they have a chapter on money where they are taught about currency and buying and selling. But even till last year, she thought that to get money all you have to do is visit a bank or an ATM.

It is essential to give them practical knowledge at home, so that they can understand the importance of earning, saving and spending. This will prepare them for the challenges of adulthood.

Top 10 ways to teach money skills to kids

You can start teaching basic money skills as early as 3 years.

Money lessons for preschoolers (3-5 years)

Identifying money

In this day and age of invisible money or plastic money, children often do not relate buying with actual money. My daughter, till a couple of years ago, thought credit card is how one make any purchases. It is thus important to introduce them to the rupee notes and coins, to show them how actual money works. Taking them along to an ATM is also a good idea.

In this day and age of invisible money or plastic money, children often do not relate buying with actual money. My daughter, till a couple of years ago, thought credit card is how one make any purchases. It is thus important to introduce them to the rupee notes and coins, to show them how actual money works. Taking them along to an ATM is also a good idea.

Do not say Yes to demands immediately

This is the age when demands start taking shape and it is our duty as well as responsibility to let them know that “yes” is not an automatic answer to everything they ask for. It is important to not give in to unreasonable demands and let them know that

Money Lessons for Primary school kids ( 6-10 years)

During the time kids are in primary school, they can be taught many important money lessons. The right foundation put at this age will serve them throughout the life.

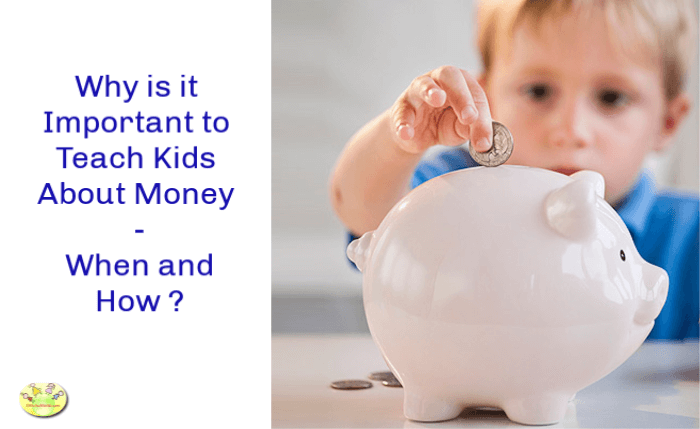

Piggy Bank

Get a piggy bank and introduce your child to the habit of saving little change. Kids love their piggy banks and they love putting all monetary gifts in them for later. It is a great joy when little change turns into a substantial amount over time which they can use to buy something of their choice. What better way to teach the first lesson in saving for a goal!

Avoid Impulse Buying

This too is a life lesson which can serve kids through their life. How often do we see something on display and buy it without thinking if we really need it or not.

You can help your kids think about the purchase they want to make. Help them understand that the toy or the game that they feel they just cannot do without at the moment may lose its appeal as soon as you reach home.

Save for goals

When kids are this age, we often give in to their demands because they are just so cute and we want to give them everything we can. But here comes the catch. Getting everything as soon as they ask for does not allow them to appreciate or be grateful. It is important to let them know that if they really want something, they must plan and save for it, just like adults need to plan and save for their life goals.

If you child wants a cycle or a video game, let them know the price and how much you can contribute to it. Remaining s/he must save. See the zeal with which they will save every penny they can and the joy and sense of achievement which they get upon reaching that goal.

Board games for Money lessons

Another good way to introduce kids this age to money lessons is by engaging them in board games like monopoly, business and game of life. Good way of bonding for the whole family while imparting some life lessons.

We also make up our own games like simply buying and selling toys and using actually notes and coins, lkearning to pay eact amounts and calculating change to be given etc.

Learning to make financial choices

One has to make judicious financial choices all our lives and the foundation can be laid early. When your child wants an expensive toy, you can impress upon the fact that they can either have the toy or the class which they have been wanting to take for a while, since you cannot afford to buy both and it is upto them choose which one is more beneficial to them and what can be pushed off for a little later.

Choosing cheaper products

Quite often as grown ups, we have to choose a cheaper product instead of a more expensive branded product because they pretty much serve the same purpose. Or we hunt for the best bargain across stores for the same product. Kids can do the same. We realized buying books online was way cheaper than buying it in stores. So, now once we browse the bookstore for a book and like it, we check it on Amazon or Flipkart. And more often than not, it is 30-40% cheaper online. My daughter resisted it initially because she wanted it immediately, but not anymore. She knows she can get it the nexxt day and we can save a bunch by buying it online.

Learning to handle peer pressure

This is something that we struggle with all our lives. We want to throw best parties, look the best, want our children to go to the best school, have everything that our friends or neighbours have. Kids too want to get the game that their best friend has. She wants the latest barbie even if she doesn’t play with 5 others that she already have. Drawing a line is necessary while explaining to them there will always be someone who has something which you do not have and that you cannot live your life trying to be like others.

Money lessons for Middle Schoolers (10-16 years)

This is the age when kids are on the verge of adulthood. They think they know more than their parents and the horizons are widening each day. So, now you must give them the freedom along with the responsibility of managing their own finances.

Budgeting

Give them a fixed pocket money and they have to use it wisely. Do not give any top-ups. It is best to not give them use of cards.

Earn your own money

If they want extra money for their needs, they can try earning some. In India, it is not very common to allow kids to work during school and college years, but it can teach them many valuable lessons.

Handle their own Bank Account

As children go into high school, you can open their own bank account, which they can operate and save their money in.

Understand the pitfalls of credit cards and loans

A lot of kids these days seem to think that all you need this a credit card and you can buy whatever you want. Teach them that credit cards are loans and you have to pay back loans along with a huge interest on top on the amount you borrowed.

Showing how little amounts add up/ compound interest

Once they have their own bank account, you can teach them how savings add up and putting in little amounts can lead up to a big amount at the end of year or so.

With these teachings growing up, kids will be much better prepared to face the financial challenges of adulthood.